Adani Enterprises, through its joint venture AdaniConneX, plans to invest $5 billion over five years to expand its data centre operations across India. The company is securing offshore loans to support its growth, aiming to develop 1 GW of capacity by 2030.

Adani Enterprises (AEL), led by billionaire Gautam Adani, is accelerating its growth in the data centre industry with its joint venture, AdaniConneX, formed in collaboration with EdgeConneX, owned by Sweden’s EQT. The company has announced plans to invest a significant $5 billion in its data centre business over the next five years, with the majority of this investment expected to be deployed in the current year. A portion of this funding will come from equity infusions from Adani Group promoters, highlighting the strong commitment to the venture.

Table of Contents

AdaniConneX’s Aggressive Expansion Plans

AdaniConneX aims to develop 1 GW of data centre capacity by 2030. The company is already in talks with several global banks to secure offshore loans between $1.2 billion and $1.4 billion to support its ambitious expansion efforts. According to sources, the loan is expected to be finalized within the next few weeks, underscoring the rapid pace at which AdaniConneX is moving forward with its growth strategy.

In a previous statement, Adani Group CFO Jugeshinder Singh mentioned that the company had a capital expenditure plan of $1.5 billion, which is spread across three years, starting from FY24. The expansion comes amid the growing demand for data centres, particularly due to the rise of AI-driven businesses and the increasing need for data localisation.

Data Centre Infrastructure and Strategic Financing

As part of its growth trajectory, AdaniConneX is looking to increase its debt financing to fuel the development of its data centres. The company has made significant progress in its facilities located in Noida, Hyderabad, and the second phase of the Chennai data centre. These sites are crucial to supporting the aggressive expansion targets of the company, which is focused on meeting the increasing demand for hyperscale data centre solutions across India.

The offshore loan, which is expected to have a five-year maturity, involves prominent global lenders such as Standard Chartered Bank, ING Bank, Sumitomo Mitsui Banking Corporation (SMBC), and MUFG Bank. This shows the confidence major financial institutions have in AdaniConneX’s expansion plans and its future prospects in the data centre market.

India’s Data Centre Industry Growth

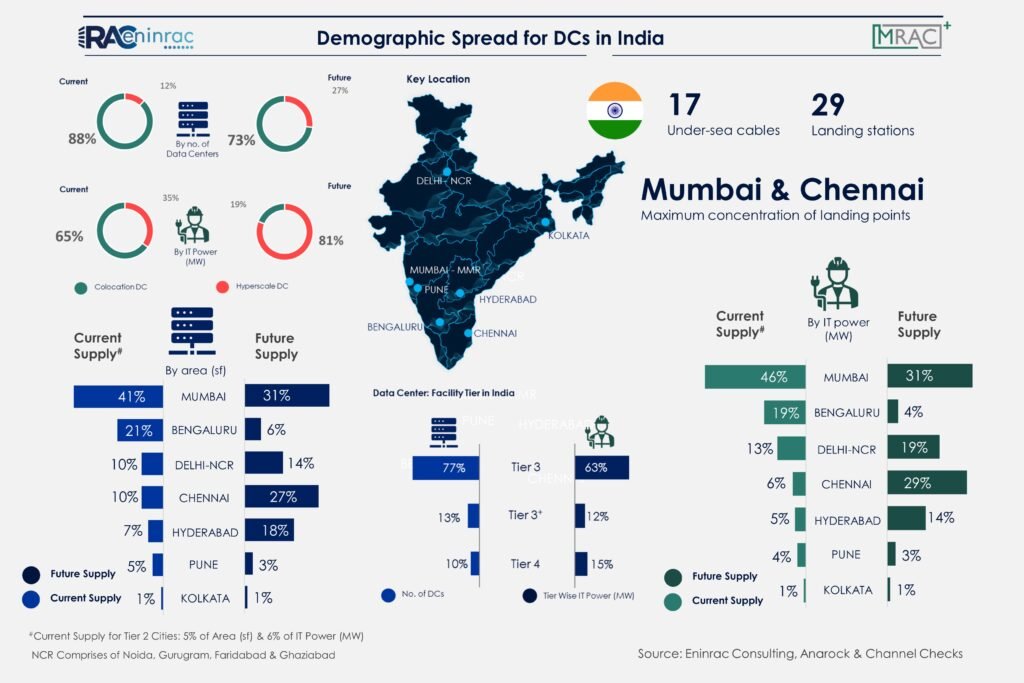

India’s data centre industry is poised for significant growth, with expectations to double in size over the next three years. According to industry reports, the capacity of India’s data centres is set to increase from 0.9 Gigawatts (GW) in 2023 to 2 GW by 2026, driven by data localisation regulations. India currently generates 20% of the world’s data but accounts for only 3% of the global data centre capacity, creating a large gap that companies like AdaniConneX are aiming to fill.

The expansion of India’s data centre capacity will require a massive capital expenditure of around Rs 50,000 crore over the next three years. This growth is being driven by the increasing demand for digital infrastructure, particularly in the wake of AI advancements and regulatory requirements surrounding data storage.

AdaniConneX’s Current and Future Data Centre Operations

Currently, AdaniConneX operates several data centres across India, with facilities in cities like Chennai, Noida, Mumbai, Pune, and Vizag. The Chennai campus provides colocation services to enterprises, while the Noida data centre, under development, is expected to have a 50 MW capacity to cater to hyperscale customers. The Chennai data centre, which started operations in 2022, aims to scale up to 33 MW.

In addition to these facilities, AdaniConneX has raised $213 million through debt facilities to finance its data centre operations in Noida and Chennai. The company has also made strategic moves in the market by acquiring two wholly-owned subsidiaries of Adani Power for Rs 540 crore in August, further bolstering its position in the growing data centre industry.

Conclusion

AdaniConneX’s aggressive investment in the data centre business highlights the growing demand for digital infrastructure in India. With a focus on expanding its capacity and developing cutting-edge facilities across key cities, Adani Enterprises is positioning itself as a major player in the country’s rapidly evolving data centre market.