The Banking Laws Amendment Bill, 2024, aims to modernize banking regulations, but critics argue it paves the way for privatization, citing concerns over reduced government ownership, cybersecurity risks, and burdensome KYC rules.

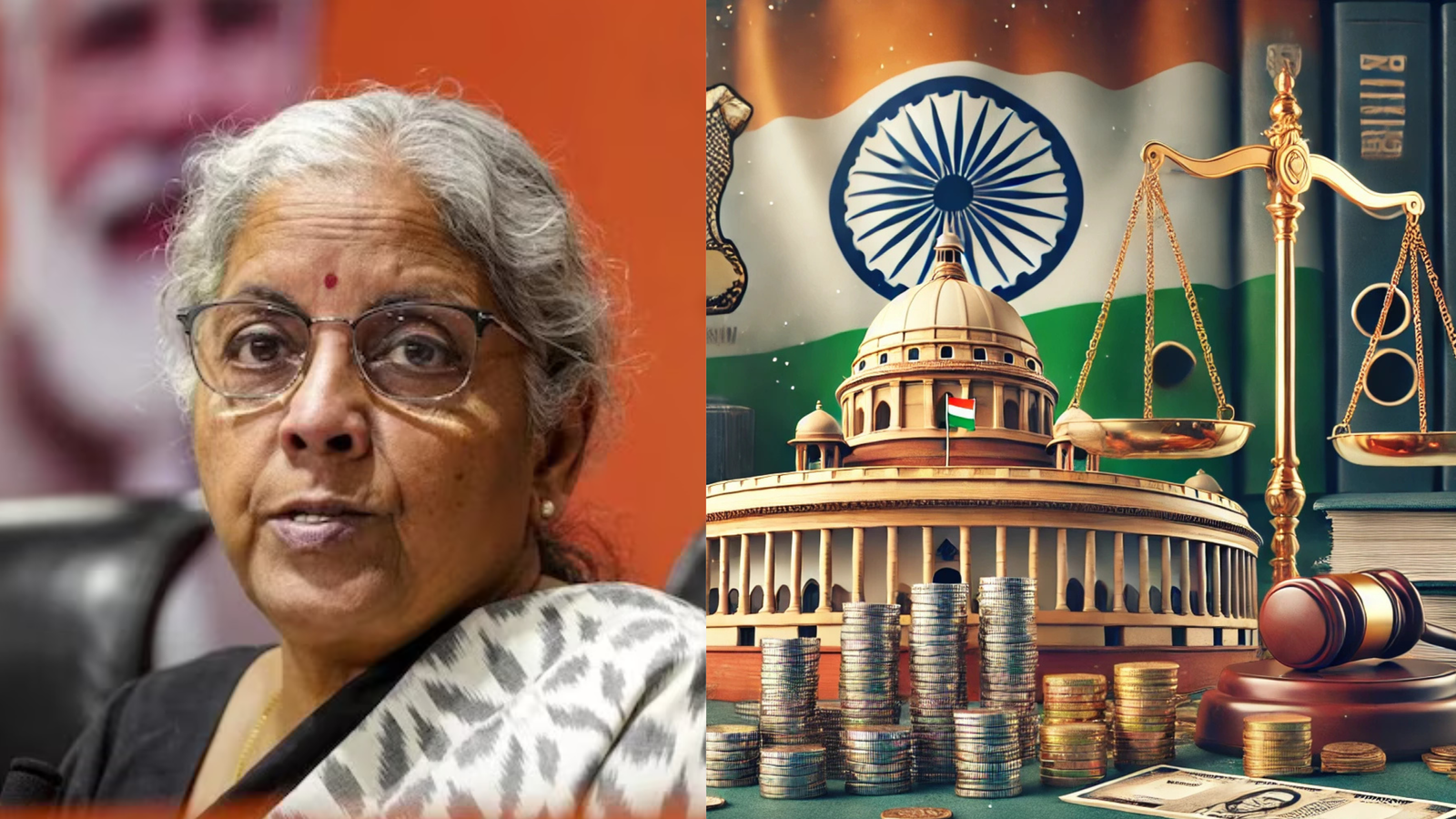

The Banking Laws Amendment Bill 2024, introduced in the Lok Sabha during the Winter Session of Parliament, has sparked widespread debate. Union Finance Minister Nirmala Sitharaman presented the bill on December 3, emphasizing its intent to strengthen governance in the banking sector and enhance customer convenience. However, opposition parties have raised concerns, alleging it paves the way for privatization. Here’s a detailed look at the proposed changes, their implications, and the criticism they have faced.

Table of Contents

Key Provisions of the Banking Laws Amendment Bill, 2024

The bill proposes several amendments aimed at modernizing banking regulations and aligning them with contemporary needs:

- Nomination Facility Expansion

Bank account holders will be allowed to nominate up to four individuals for their accounts. This flexibility extends to locker holders, who will have the option of successive nominations. This move aims to enhance customer convenience and streamline asset transfer processes in case of emergencies. - Redefinition of ‘Substantial Interest’ for Directorships

The bill increases the cap on ‘substantial interest’ from ₹5 lakh to ₹2 crore for directorship eligibility. This threshold was last updated nearly six decades ago and is being revised to reflect current economic realities. - Extended Tenure for Cooperative Bank Directors

The tenure of directors in cooperative banks (excluding the chairman and whole-time directors) will be extended from eight to ten years. This aligns with the Constitution (Ninety-Seventh Amendment) Act, 2011, which governs cooperative societies. - Cross-Directorships in Cooperative Banks

A director of a Central Cooperative Bank will now be allowed to serve on the board of a State Cooperative Bank, aiming to enhance governance and coordination across these entities. - Freedom in Auditor Remuneration

Banks will be given more autonomy in deciding the remuneration for statutory auditors, potentially attracting higher-quality professionals to oversee banking operations. - Streamlined Reporting Dates

Regulatory reporting deadlines will shift to the 15th and last day of each month, replacing the existing second and fourth Friday schedule. This change is intended to enhance regulatory compliance and operational efficiency.

Opposition Criticism: A Step Toward Privatization?

Despite its stated benefits, the bill has drawn sharp criticism from opposition leaders who argue it lays the groundwork for privatizing public sector banks.

- Concerns Over Government Ownership

TMC MP Kalyan Banerjee called the bill a “donkey passage towards privatization,” alleging it covertly seeks to reduce the government’s minimum stake in public sector banks from 51% to 26%. - Cybersecurity Challenges

Banerjee and Congress MP Karti Chidambaram highlighted the growing risks of cyber fraud in the banking sector. They called for robust IT infrastructure, enhanced fraud detection mechanisms, and strict adherence to data privacy regulations to safeguard customer interests. - The ‘Tyranny of KYC’

Chidambaram also criticized the repetitive Know Your Customer (KYC) updates imposed on account holders. He urged the government to simplify KYC regulations and mandate updates only when there are changes to the customer’s details.

Government’s Defense

Union Finance Minister Nirmala Sitharaman defended the bill, asserting that its provisions are designed to bolster banking governance, enhance customer convenience, and protect depositors. She noted that the government, in coordination with the Reserve Bank of India (RBI), has taken significant steps since 2014 to ensure the stability and health of the banking sector.

“We are committed to keeping our banks safe, stable, and healthy. The amendments are aimed at governance improvements and offering better services to depositors,” Sitharaman stated.

Balancing Reform with Public Confidence

While the bill introduces significant reforms, its critics argue that it lacks adequate measures to address pressing challenges like cyber threats and customer grievances. The government’s focus on reducing bureaucratic hurdles and modernizing banking practices is commendable, but it must address the concerns raised to maintain public trust.

Conclusion

The Banking Laws (Amendment) Bill, 2024, marks a significant shift in India’s banking framework, aiming to modernize decades-old regulations. While the proposed changes offer several benefits, the criticism from opposition parties underscores the need for careful deliberation. As the debate unfolds, striking a balance between reform and public interest will be critical to the bill’s success.